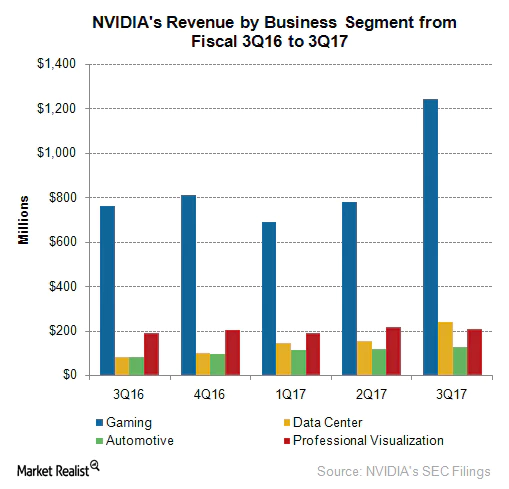

On the other hand, Gaming also has a lower growth rate than the Datacenter segment, although it has returned to an impressive level around 68% (Figure 3). It increased from 41% in 2015 to the most recent 53.7% (Figure 2). Gaming is still Nvidia's largest revenue segment. In the following sections, I will examine the 2018 growth outlook for Nvidia's largest or fastest-growing segments. As a result, Nvidia's near-term overall growth rate may show an unexpected improvement since the historical "growth dilution" from a large revenue base may not materialize this time.

The smaller revenue share segment shows the largest growth potential Datacenter delivered over 70% year-to-year revenue growth (Figure 3) but represents the smallest end user, contributing less than 22% to revenue (Figure 2).įor the first time, Nvidia's GPU business, representing 86% of Q1 revenue, also dictates the company's 77% year-to-year revenue growth, which is significantly higher than the 33% Tegra Processor growth rate. Ironically, Nvidia's only potential bad news may be a result of its own success. All segments across the board have delivered growth rates exceeding expectations. The good news is that Nvidia has fended off Advanced Micro Devices' (NASDAQ: AMD) recent assault on the GPU market and has been proven to be less affected by the volatility of the Bitcoin market. Based on the product classification, I used a "sum of the parts" method to estimate NVDA's target price for the rest of 2018. In this article, I attempt to address this question.

At this point, the most common concern regards NVDA's seemingly high valuation, which may not be justified by its forecast fundamentals. It is always pleasant to value Wall Street darling Nvidia's (NASDAQ: NASDAQ: NVDA) stock.

0 kommentar(er)

0 kommentar(er)